Application Requirements

A withholding agent shall file and pay the tax withheld to the competent tax authority at the place where it is domiciled within 7 days of the date on which the withholding obligation occurs.

Legal Basis

1. Article 25, Paragraph 2 of the Law on Administration of Taxation of the People’s Republic of China

2. Article 3, Article 37, Article 38, and Article 40 of theEnterprise Income Tax Law of the People’s Republic of China

Materials Needed

Notes:

1. Taxpayers are responsible for the authenticity and legality of the materials submitted.

2. Taxpayers are required to submit paper documents when they go to the tax service hall to handle their tax affairs, or submit electronic documents according to the operation requirements of the online system if they handle their tax affairs online or through mobile terminals.

3. For materials not specified as original or printed copies in the “Materials Needed” list, the original copies shall be provided; for materials specified as printed copies, only printed copies shall be provided; for materials specified as original and printed copies, the printed copies will be collected and the original copies will be returned after verification.

4. Taxpayers may use e-signatures that meet the requirements of the Electronic Signature Law of the People’s Republic of China, which has the same legal effect as handwritten signatures or seals.

5. The submitted printed copies must state its consistency with the original copies and be stamped with the company’s official seal or signed by the taxpayer.

Service Channels

1. Tax Service Halls (Click to view the location, opening hours and contact information of the tax service halls)

“City-wide Universal Processing” services will be provided at all tax service halls except for the Second Tax Bureau of Shenzhen Municipality.

2. Self-service tax terminal access is currently unavailable.

3. Online service

E-tax bureau (e-tax bureau) service is available.

Mobile terminal (tax bureau) and WeChat (tax bureau) access is currently unavailable.

Processing Authority

The competent tax authorities

Processing Time

1. Time limit for taxpayers

A withholding agent shall file and pay the tax withheld to the competent tax authority at the place where it is domiciled within 7 days of the date on which the withholding obligation occurs.

2. Time limit for tax authorities

The tax authority shallcomplete the procedure immediately after acceptance.

Tel.

Please refer to the tax service map for contact numbers of each tax service hall.

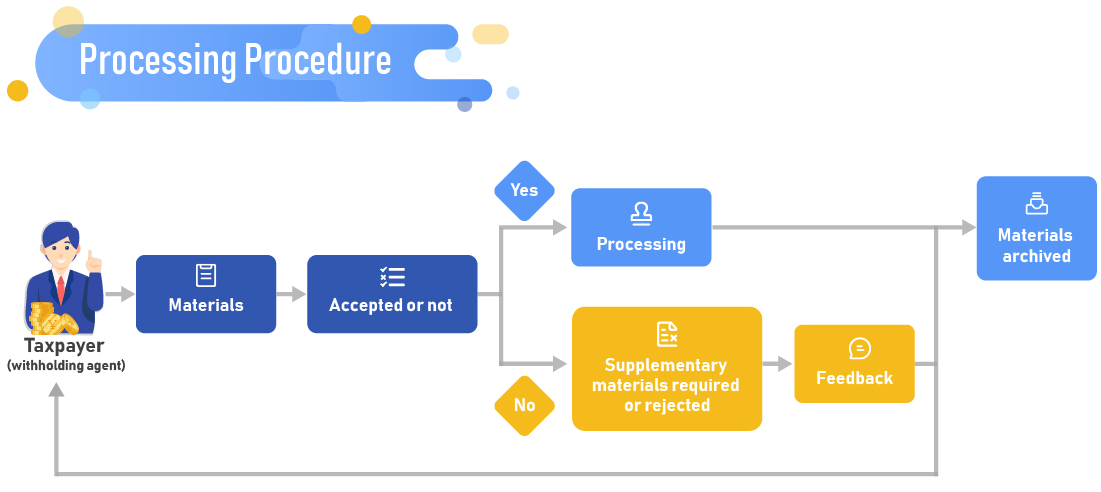

Processing Procedure

Processing Result

Tax authorities will give feedback on the result.

Notices for Taxpayers

1. The tax authorities provide single-window service. Taxpayers need to visit the tax authorities only once at most on the precondition that the materials are complete and meet the legal requirements for acceptance.

2. Transfer by a non-resident enterprise of its shareholdings in a resident (PRC tax resident) enterprise to its wholly-owned (100%) resident subsidiary may qualify for the “special tax treatment,” provided that:

(1) The transfer is conducted with legitimate business purposes and the main purpose thereof is not to reduce, exempt or defer tax payments;

(2) The ratio of the assets or equity being purchased, merged or split satisfies the ratio set forth in the relevant government stipulations;

(3) The original substantive business activities of the restructured assets remain unchanged for twelve consecutive months after the restructuring;

(4) The ratio of the consideration in the transaction settled by equity satisfies the ratio set forth in the relevant government stipulations; and

(5) The original major shareholder shall not transfer the acquired equity for twelve consecutive months after the restructuring.Transfer by a non-resident enterprise of its shareholdings in a resident enterprise to its wholly-owned (100%) non-resident subsidiary may qualify for the “special tax treatment,” provided that the withholding tax (WHT) rate applicable to the gain on the future disposal of such shareholdings is not reduced, and that the non-resident transferor makes a written promise to the tax authorities that it will not dispose of its interest in the non-resident transferee within three years (including three years) of the restructuring.

3. Where a non-resident enterprise elects for “special tax treatment” on equity transfer transactions, in the case of a non-resident enterprise transferring its shareholdings in a resident enterprise to its wholly-owned (100%) non-resident subsidiary, the transferor shall make the filing with the tax authority at the place where the transferee is domiciled; in the case of a non-resident enterprise transferring its shareholdings in a resident enterprise to its wholly-owned (100%) resident subsidiary, the transferee shall make the filing with the tax authority at the place where it is domiciled.

Fees

Free of charge

Application Forms

The form can be downloaded from the “Tax Services” – “Download Center” – “Form Download” section of the Shenzhen Tax Service website, State Taxation Administration (specific download address) or collected from the tax service halls.

Instructions for Filling out Forms

Please see the instructions for filling out as shown in the relevant forms.