Application Requirements

Enterprises shall, in accordance with Article 114 of the Regulation on the Implementation of the Enterprise Income Tax Law of the People’s Republic of China, prepare contemporaneous documentation with respect to their related party transactions for each tax year and submit the documentation upon the tax administration’s request. Contemporaneous documentation may include a master file, a local file and a special issue file.

Legal Basis

1. Article 43 of the Enterprise Income Tax Law of the People’s Republic of China

2. Article 114 of the Regulation on the Implementation of the Enterprise Income Tax Law of the People’s Republic of China

3. Article 10 of the Public Notice of the State Taxation Administration (STA) on Matters Regarding Refining the Filing of Related Party Transactions and Administration of Contemporaneous Transfer Pricing Documentation (STA Public Notice[2016] No. 42)

Materials Needed

Notes:

1. Taxpayers are responsible for the authenticity and legality of the materials submitted.

2. Taxpayers are required to submit paper documents when they go to the tax service hall to handle their tax affairs, or submit electronic documents according to the operation requirements of the online system if they handle their tax affairs online or through mobile terminals.

3. For materials not specified as original or printed copies in the “Materials Needed” list, the original copies shall be provided; for materials specified as printed copies, only printed copies shall be provided; for materials specified as original and printed copies, the printed copies will be collected and the original copies will be returned after verification.

4. The submitted printed copies must state its consistency with the original copies and be stamped with the company’s official seal.

Service Channels

1. The department in charge of international tax administration of the competent tax authority

“City-wide Universal Processing” services currently are not provided by any tax service halls.

2. Self-service tax terminal service is currently unavailable.

3. Online service

Currently there are no online services available for filing contemporaneous documentation reports.

Processing Authority

The competent tax authorities

Processing Time

1. Time limit for taxpayers

A master file shall be completed within 12 months of the fiscal year end of the ultimate holding company of the enterprise group; local file and special issue file shall be completed by 30 June of the year following the year during which the related party transactions occur. Contemporaneous documentation shall be submitted within 30 days after receiving a request from the tax authorities.

Enterprises that fail to submit contemporaneous documentation due to an event of force majeure shall submit the contemporaneous documentation within 30 days after the event of force majeure ceases to prevent the submission.

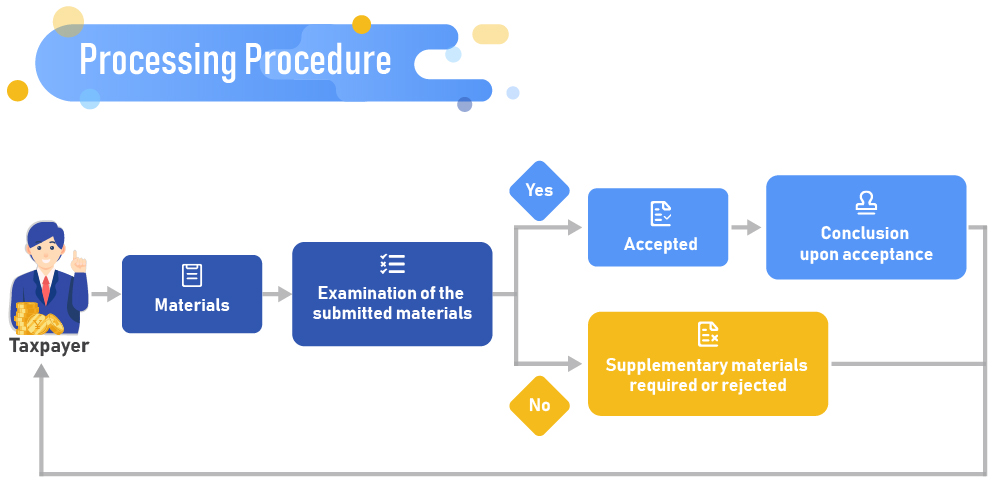

2. Time limit for tax authorities

The tax authority shall complete the procedure immediately after acceptance.

Tel.

Please refer to the tax service map for contact numbers of each tax service hall.

Processing Procedure

Processing Result

N/A.

Notices for Taxpayers

1. Contemporaneous documentation shall be prepared in Chinese with the sources of information specified.

2. Contemporaneous documentation shall be stamped with the company seal, and signed and sealed by the company legal representative or the authorized delegate of the legal representative.

3. Any enterprise that meets either of the following criteria shall prepare a master file:

(1) The enterprise that has conducted cross-border related party transactions during the tax year concerned, and the enterprise group to which the ultimate holding company that consolidates the enterprise belongs, has prepared a master file.

(2) The annual total amount of the enterprise’s related party transactions exceeds one billion RMB.

4. Any enterprise whose annual amount of related party transactions meets any of the following criteria shall prepare a local file:

(1) The annual related party transfer of ownership of tangible assets exceeds 200 million RMB (for toll manufacturing transactions, the amount is calculated using the import/export customs declaration prices).

(2) The annual related party transfer of financial assets exceeds100 million RMB.

(3) The annual related party transfer of ownership of intangibles exceeds 100 million RMB.

(4) The annual total amount of other related party transactions exceeds 40 million RMB.

5. An enterprise that enters into or implements a cost sharing agreement (hereinafter referred to as “CSA”) shall prepare a special issue file for the CSA. An enterprise with a related party debt-to-equity ratio exceeding the threshold shall prepare a special issue file on thin capitalization to demonstrate its conformity with the arm’s length principle.

6. A master file shall be completed within 12 months of the fiscal year end of the ultimate holding company of the enterprise group; local file and special issue file shall be completed by 30 June of the year following the year during which the related party transactions occur. Contemporaneous documentation shall be submitted within 30 days after receiving a request from the tax authorities.

7. Enterprises that fail to submit contemporaneous documentation due to an event of force majeure shall submit the contemporaneous documentation within 30 days after the event of force majeure ceases to prevent the submission.

8. Enterprises with effective advance pricing agreements in place may choose not to prepare a local file and a special issue file with respect to the related party transactions covered by such advance pricing agreements, and the amount of these related party transactions is excluded from the calculation of the stipulated thresholds of the annual amount of related party transactions.

9. Enterprises with only domestic related party transactions may choose not to prepare a master file, a local file or a special issue file.

10. For an enterprise group that is required to prepare a master file in accordance with the regulations, if the subsidiaries in the group are under the jurisdiction of more than two tax authorities, it may choose to take the initiative to submit the master file to either of the competent tax authorities. In case other subsidiaries in the group are required to provide a master file by the competent tax authorities, they may be exempted from providing it after reporting in writing to the competent tax authorities that the group they belong to has taken the initiative to provide the master file. “Taking the initiative” therein refers to the case where the enterprise provides a master file before the special tax investigation is initiated by the tax authorities. If a subsidiary in the group is subject to special tax investigation by the tax authorities and has provided the master file as required, other subsidiaries in the group will not be exempted from providing the master file, but the group may still choose to submit the master file to either of the competent tax authorities.

11. Enterprises engaged in simple manufacturing for overseas related parties such as toll processing or processing with imported materials, simple distribution or contract research and development, should maintain a reasonable level of profit. If the aforementioned enterprise incurs a loss, regardless of whether it exceeds the thresholds for preparing contemporaneous documentation as prescribed in the Public Notice of the State Taxation Administration (STA) on Matters Regarding Refining the Filing of Related Party Transactions and Administration of Contemporaneous Transfer Pricing Documentation (STA Public Notice [2016] No. 42), it should prepare contemporaneous documentation local files for the loss-making years.

12. In the event of a merger or divestiture, the relevant contemporaneous documentation shall be kept by the surviving enterprise after the merger or divestiture.

13. Contemporaneous documentation shall be kept for 10 years from the completion date of the preparation as required by the tax administrations.

Fees

Free of charge

Application Forms

N/A.

Instructions for Filling out Forms

N/A.